Trump is tanking the US dollar and markets

The presidency of Donald Trump had a profound impact on U.S. markets and the dollar, characterized by volatility and significant policy shifts. Trump's tenure saw a mix of economic policies, including tax reforms, deregulation, and trade wars, which collectively influenced market dynamics and the value of the dollar.

Market Volatility and Policy Shifts

Trump's approach to economic policy was marked by unpredictability. His administration implemented substantial tax cuts, particularly benefiting corporations, which initially boosted stock markets. The Tax Cuts and Jobs Act of 2017 reduced the corporate tax rate from 35% to 21%, leading to increased corporate profits and stock buybacks. However, Trump's trade policies, especially the trade war with China, introduced significant uncertainty. Tariffs imposed on Chinese goods led to retaliatory measures, affecting global supply chains and investor sentiment.

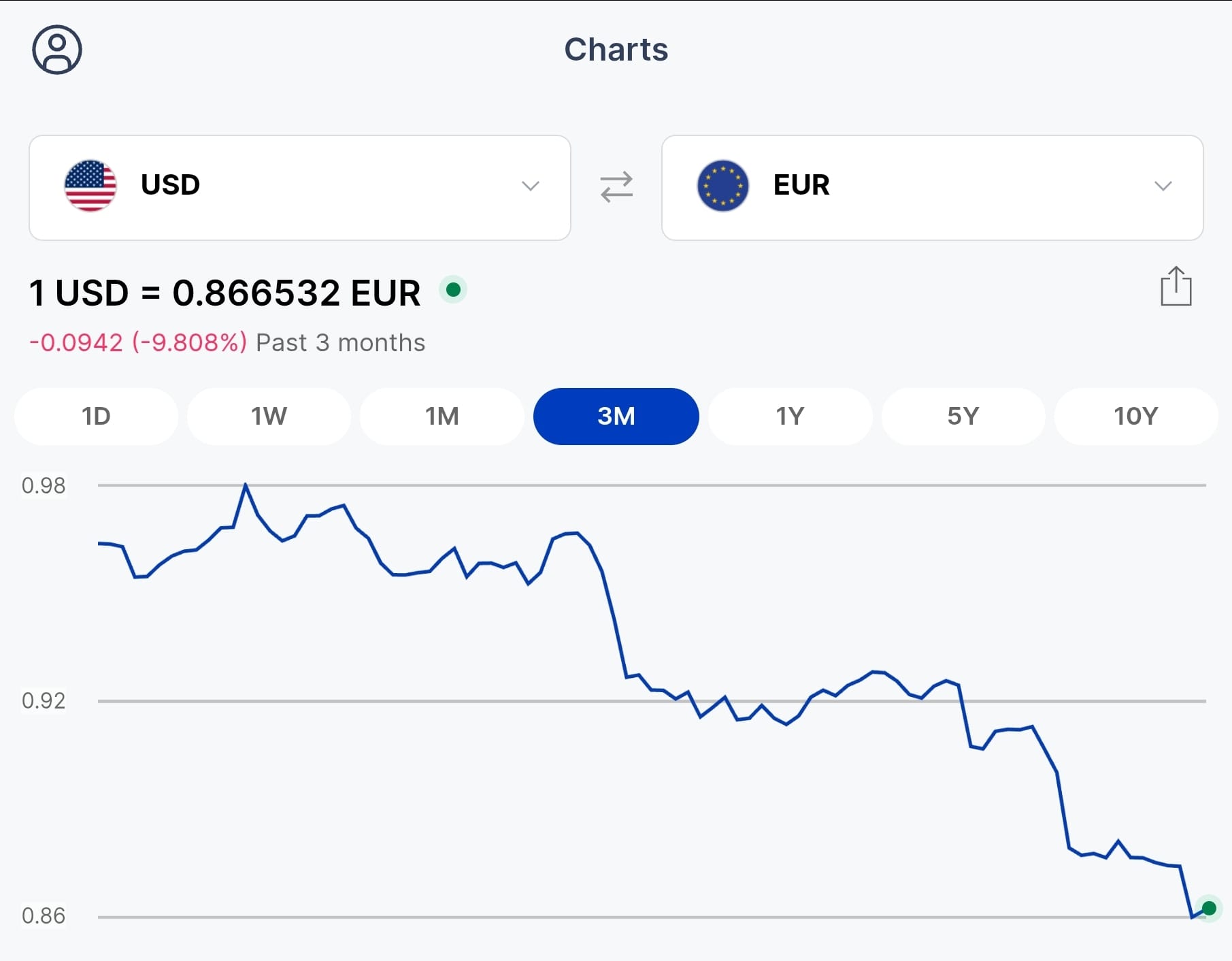

Impact on the Dollar

The U.S. dollar experienced fluctuations during Trump's presidency. Initially, the dollar strengthened due to expectations of higher economic growth and interest rates following the tax cuts. However, Trump's frequent criticisms of the Federal Reserve and its chair, Jerome Powell, created uncertainty around monetary policy. Trump's calls for lower interest rates and his threats to fire Powell led to concerns about the Fed's independence, which negatively impacted the dollar's value. Recently, the dollar hit a three-year low amid fears of further interference in the Fed's operations.

Long-Term Effects

The long-term effects of Trump's policies on U.S. markets and the dollar are still unfolding. While the tax cuts provided a short-term boost, the trade wars and political uncertainty have had lasting impacts. Investors remain cautious about potential policy shifts and their implications for market stability and economic growth.

In summary, Trump's presidency brought both opportunities and challenges for U.S. markets and the dollar. The combination of tax reforms, trade policies, and political unpredictability created a complex economic landscape that continues to influence investor behavior and market performance.